TRANSITION CORNWALL, JOHN TOWNDROW

I asked a friend of mine the other day how he intended to spend his Gov’t of Canada Climate Action Incentive Payment and he said he wasn’t sure if he even got that. I thought, wow, if he didn’t know he was eligible then the polls were right, that 40% of Canadians don’t realize they are entitled to this sizeable tax-free payment, designed to help individuals and families offset the cost of pollution.

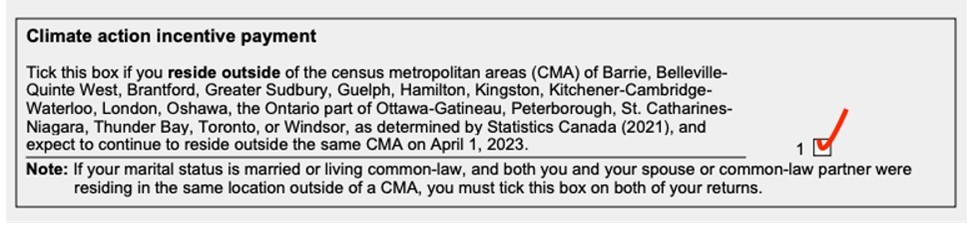

The Climate Action Incentive Payment (CAIP), is paid automatically every three months (by direct deposit or cheque) if you ticked the box on your income tax return. All you have to be is a resident of Canada for income tax purposes. The good news is everyone is eligible for the same amount, no matter your income. It varies from province to province but in Ontario, it is laid out as follows:

$488 for an individual

$732 for a married or common-law couple

$122 per child under 19

$244 for the first child in a single-parent family

In addition, for those of us living outside a major metropolitan area, like Cornwall and the counties, you get an extra 10%. So a family of 2 adults and 2 children under 19 in the Cornwall and area gets $1073.60 per year.

As I mentioned, this varies with provinces, so Albertans (the loudest protestors about the carbon levy by the way) get almost twice as much as Ontarians. Also, if you are a newcomer to Canada, check out the Canada Revenue Agency website to claim your incentive payment.

So my question to my friend was “what do you plan to do with this”?. For many, of course, it will pay some essential bills, put food on the table or just give a little boost to basic expenses. For those people who have sufficient income already there are many useful ways to spend this incentive payment. You might support a charity of your choice, upgrade your home for more energy efficiency to reduce you carbon footprint. The important thing to know is that, contrary to the many false statements made about the carbon levy, 80% of Canadians get more back from the incentive payment than they pay out in carbon tax, plus you are free to spend it any way you want.

So even if you have little or no income it’s a good idea to file your income tax return so you don’t lose out on hundreds of dollars a year, especially if you are a family with several children. The carbon levy is an incentive to use less fossil fuel to help address climate change and as an added bonus you get some money in return. How good is that?

For more information on Transition Cornwall+ or to add you name to our mailing list: transitioncornwall.com